Consolidation in the technology space. It’s happening. Much has been said, heard and analysed when it comes to the recent Whatsapp acquisition by Facebook. Valuations were being tossed around and here’s an interesting graphic on whether it was worth $19 billion to start with. That being said, i’m looking at bigger forces at play in the technology space. As textbook economics will tell you, consolidation is a phase that kicks in mature markets when the big players begin to swallow the smaller and more active ones up.

Acquisitions have been happening for quite sometime now. But some of the interesting one’s in recent times have been Google buying Motorola and then selling it off to Lenovo. Microsoft buying out Nokia and they did give in to market pressures by releasing an Android phone just yesterday at the Mobile World Congress’14. Microsoft also bought Skype nearly a year back and killed its own messenger. Software firms have been increasingly snapping up hardware companies. It’s clearly about building capabilities to have more integrated software and hardware. Apple has been doing this for decades with a very closely knit user interface that has been winning customers over for years. Pretty much like them, the other companies are also trying to tightly integrate services to have the customers locked in for longer period of time. Look at Google, that is trying to foray in to nearly every possible nook of our life as it builds its inventory for the internet of things. You’re using maps, gmail, search and docs for starters. As any marketeer will tell you, its always cheaper to retain customers than to go out and acquire new ones.

Here’s a drill-down of what i think about the entire consolidation bit:

1. Customer stickiness: Companies want customers to buy a product and integrate it so tightly that they are unable to breakout.

2. Eat the competition: As start-ups have more breathing room and flexibility for innovation, let them build great products as the big cats will swallow them up to eventually kill the competition if any.

3. M&A industry: Who else is laughing all the way to the bank? Consulting firms. In fact software acquisitions made up nearly half of the deal value in this space as per PwC.

4. Increasing usage: Big tech players are always looking for means to increase usage and as Metcalf’s law says, the value of any network lies in the number of connected users on it. Hence you see why software services have been aggressively merging or finding new ways of driving usage for their platforms.

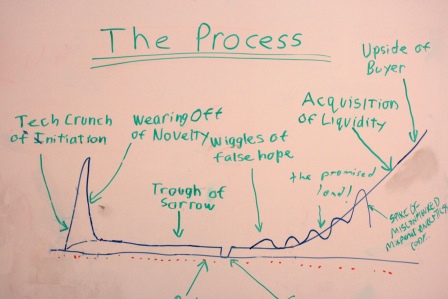

5. Start-ups don’t always need an IPO: It’s increasingly difficult for a small company to go public and put itself under the scanner. Investors and analysts will slice and dice not only excel spreadsheets but also any single move that key people make. By cashing out and selling themselves to a larger firm, they can avoid all the pain. All of this when they might have not even achieved the vision they started out with.

6. Hide failures better: The chances of a start-up making it big are rather slim. In fact, the odds seem to be against them. Once they have generated enough buzz and got a fancy valuation. The small fish can then afford to dissolve in the system and chances are if they were going to fail, little would anyone get to know about it.

With all of this in place, we can only hope for better products and services. While some of these partnerships may have benefited the firms, what remains to be seen is how innovative they can really get. For now, the entire space has become a playground for many small firms to pitch their products and see how quickly they can go to market or gain more funding. At the end, the customer stands to benefit the most from this!

*Image source: Flickr (labelled for reuse)